BIR Tax Calendar For Year 2023

From (www.bir.gov.ph)

By Mary Aileen Lim

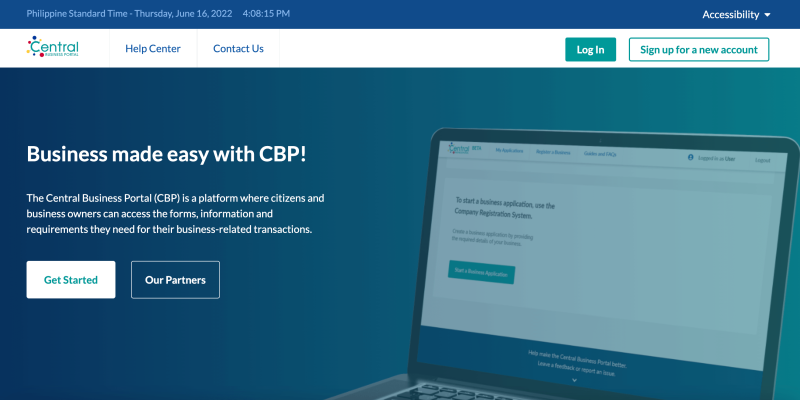

Starting March 15, 2022, sole proprietors with no existing Taxpayer I d e n t i f i c a t i o n Number (TIN) can register their businesses with the Central Business Portal (CBP).

This was made possible with the integration of the CBP with the Department of Trade and Industry’s (DTI) Business Name Registration System (BNRS). Prior to the integration, only corporations and partnerships can register their businesses online through the CBP.

The CBP is a project of the Anti-Red Tape Authority (ARTA), in coordination with the Department of Information and Communication Technology (DICT), that caters to the centralized and online registration of corporations partnerships with different concerned government agencies, such as Securities and Exchange Commission (SEC), Bureau of Internal Revenue (BIR), Philippine Health Insurance Corporation (PhilHealth) and Home Development Mutual Fund (PAG-IBIG).

The CBP has the following features and functionalities: registration and approval of Business Name with DTI; issuance of Taxpayer Identification Numbers (TINs) to sole proprietors with no existing TINs; identification of the national internal revenue taxes which the sole proprietor will be liable to; payment of the Annual Registration Fee (ARF) of Five Hundred Pesos (₱ 500.00) and loose Documentary Stamp Tax (DST) of Thirty Pesos (₱ 30.00) electronically through various ePayment facilities or manually at the Revenue District Office (RDO); and issuance of an electronic Certificate of Registration (COR), which can be printed in A4 paper size by the taxpayers at their end for thosewho opted to pay the ARF and loose DST online.

After securing the BIR electronic COR through the CBP, taxpayers (sole proprietors) who want to start their business operations immediately after registration shall proceed to the RDO (indicated in the electronic COR) to buy BIR Printed Receipts/Invoices (BPR/BPI). They also have the option to apply for an Authority to Print (ATP) their own receipts/invoices at the RDO if they want their receipts/invoices to be printed by BIR Accredited Printers.

To ensure accuracy and correctness of taxpayer’s registration information, particularly the tax types that were identified by the taxpayer, the assigned BIR officer shall reevaluate the registered tax types of the CBP applicant who shall proceed to the RDO for the application of an ATP Receipts/Invoices or buy BPR/BPI. They shall also update the records of the taxpayer, when necessary, by reflecting and/or correcting the details and tax types in the Internal Revenue Integrated System-Taxpayer Registration System (IRIS-TRS) as well as re-issue an updated

COR, if applicable.

Sole proprietors with existing TINs shall manually register their business at their respective RDO following the existing BIR policies and procedures.

(From BIR Press Release 2022, bir.gov.ph )

Main Office: